In the crypto world, speed, security, and interoperability are no longer optional—they are essential. Emerging from this need, Sonic—formerly known as Fantom—has completely overhauled its infrastructure to establish itself as a major force in the Web3 era. As a high-performance Layer-1 blockchain network, Sonic is built to deliver scalability, efficiency, and lightning-fast transactions.

The rebranding on August 1, 2024, wasn’t just a name change; it represented a strategic shift in vision. With this new identity, Sonic aims to offer greater scalability, faster transaction finality, lower fees, and a more developer-friendly Web3 environment. The network’s native token FTM became convertible 1:1 into the new S token, with the migration window remaining open for six months.

Core Pillars of Sonic: Speed, Security, and Interoperability

With its upgraded infrastructure, Sonic can theoretically process up to 10,000 transactions per second (TPS), with sub-second finality. This places Sonic among the fastest blockchains in the market.

At the heart of the network lies the Lachesis consensus protocol, built on asynchronous Byzantine Fault Tolerance (aBFT). Unlike traditional blockchains, Lachesis processes transactions by linking events rather than fixed blocks, allowing faster confirmation, reduced data usage, and ultra-low fees—typically as low as $0.001 per transaction.

Sonic is also fully compatible with the Ethereum Virtual Machine (EVM), allowing developers to migrate Ethereum-based smart contracts without modifications. The Sonic Gateway bridge facilitates secure and low-latency cross-chain transactions between Sonic and Ethereum.

A Powerful Developer Incentive Model

Sonic Labs introduces an innovative revenue-sharing model to support on-chain developers. Through the Fee Monetisation (FeeM) program, developers can earn up to 90% of transaction fees generated by their decentralized applications (dApps).

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

This model resembles how content creators earn income through platforms like YouTube or TikTok, making Sonic not only technically compelling but also financially rewarding for builders.

S Tokenomics and Network Design

The S token is the native utility token of the Sonic network. It powers the ecosystem by enabling fee payments, staking, governance participation, and validator rewards. It also replaces the former Fantom (FTM) token, with a seamless 1:1 conversion process designed to onboard the existing community.

Key Metrics

- Total Supply: 3.175 billion S

- Initial Circulating Supply: ~2.88 billion S

- Maximum Supply: None (regulated through controlled inflation and burn mechanisms)

Airdrop Program

Six months post-mainnet launch, an additional 6% of S tokens (~190.5 million) will be minted and distributed to both Fantom Opera and Sonic users and builders.

- 75% of airdropped tokens are locked in a 270-day vesting period.

- Early claims are penalized via token burns to incentivize long-term commitment and active participation.

Inflation & Block Rewards

To maintain decentralization and incentivize validators, Sonic follows a balanced issuance model:

- For the first 4 years, no new S tokens will be minted. Rewards will be funded using unclaimed Fantom Opera block incentives.

- After year 4, new S tokens will be minted annually at a controlled rate of 1.75%.

- Each year, 47.625 million S tokens will be allocated for network growth, team expansion, and marketing—any unused tokens will be permanently burned.

| Category | Percentage | Approximate Allocation |

|---|---|---|

| Block Rewards | 33.9% | 1.08 billion S |

| Token Sale | 26.5% | 840 million S |

| Market Development | 19.8% | 630 million S |

| Team & Founders | 9.9% | 315 million S |

| Advisors/Contributors | 9.9% | 315 million S |

The structure has been preserved post-transition, with greater flexibility introduced through staking incentives, dynamic burning, and airdrop-based community growth.

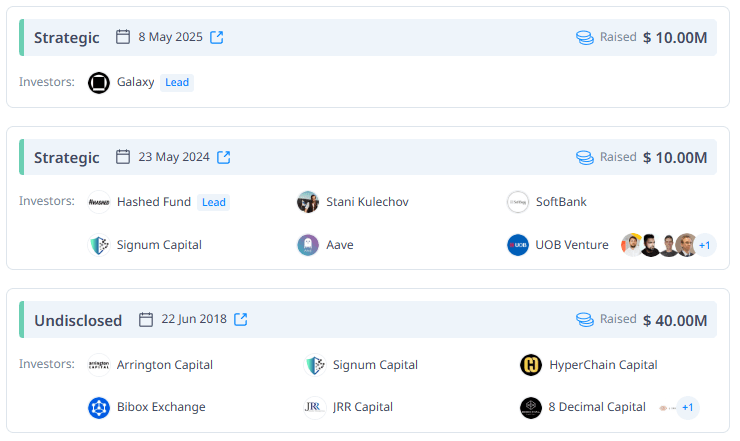

Funding and Investors

To date, Sonic has raised a total of $101.54 million. 59% came from private rounds, and 41% through public sales.

Notable Investors:

- Galaxy Digital

- OKX Ventures

- SoftBank

- Hashed Fund

- Signum Capital

- Andre Cronje (Creator of Yearn Finance, Advisor)

- Stani Kulechov (Founder of AAVE)

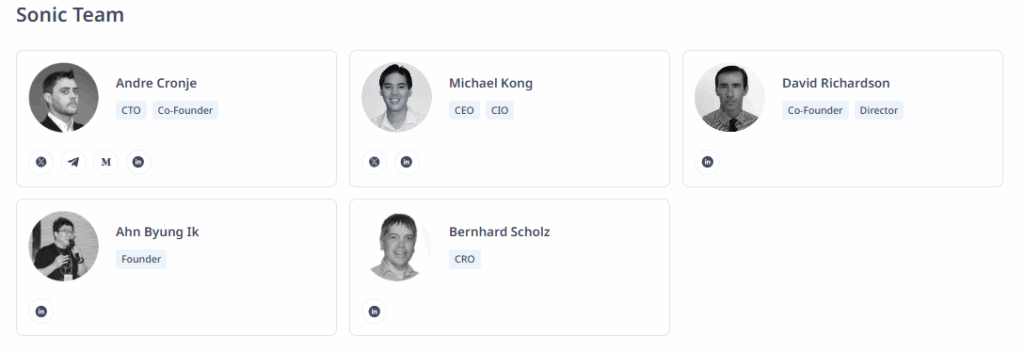

Sonic Team

- Michael Kong – CEO

- Andre Cronje – CTO, DeFi Architect & Advisor

- Ahn Byung Ik – Founder

- David Richardson – Co-founder

- Bernhard Scholz – CRO

Staking & Validator Incentives

S token holders can stake their tokens to support network security and earn rewards. Depending on the total staked supply, annual reward rates range from 1.75% to 7%. A 14-day unbonding period applies for unstaking.

Validators also earn a share of network fees in addition to block rewards, further incentivizing honest and secure participation in network operations.

The Future of Sonic

Sonic is on a mission to build a sustainable, high-speed digital economy for the Web3 era. With comprehensive developer tools, built-in interoperability, and negligible transaction costs, Sonic positions itself not just as a blockchain—but as a full-fledged decentralized ecosystem.

Already integrated into sectors like NFTs, DeFi, gaming, and enterprise services, Sonic aims to expand globally through strategic partnerships, ecosystem funding, and community-driven development.

Official Links

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.