Investors expecting a bullish rally in the crypto market experienced their second-largest liquidation day in October. The sharp declines in Bitcoin and Ethereum have increased total crypto liquidations. On October 23, a total of $261 million was liquidated in the crypto market, $203.5 million of which came from long positions. This liquidation was recorded as the second-largest liquidation after the $450.8 million liquidation at the beginning of October.

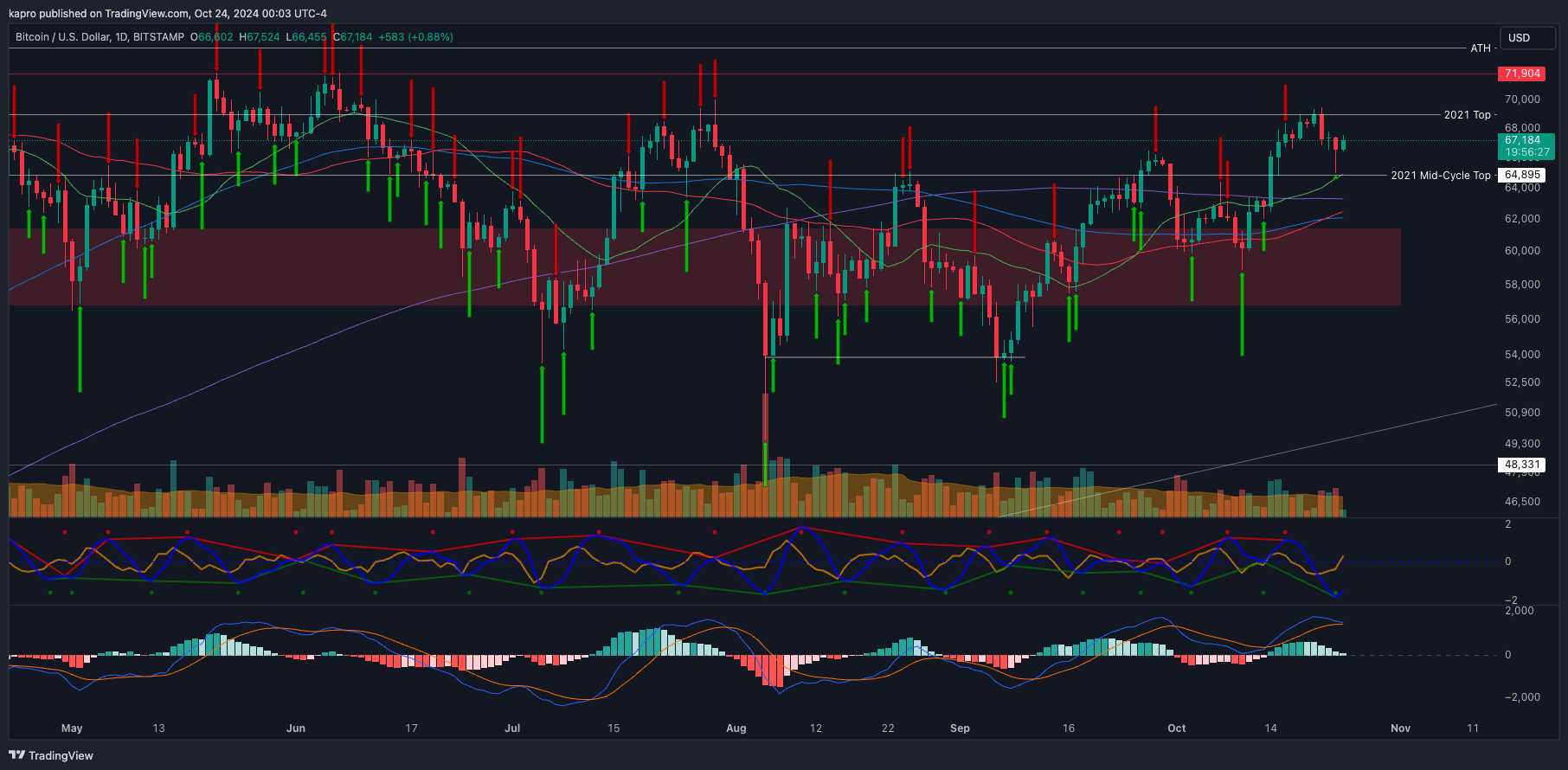

Ethereum, in particular, suffered the biggest loss. $77 million worth of Ethereum long positions were liquidated, while $58.3 million worth of Bitcoin liquidated. Ethereum fell 1.7% in 24 hours to $2,552. Bitcoin, on the other hand, reached a three-month high approaching $70,000 on October 21, but fell to $65,500 on October 23 before recovering to $67,386.

The biggest reason behind the liquidations was that the positions opened by investors expecting Bitcoin to continue to rise were reversed with the decline in the market. Ethereum’s high transaction fees reduced demand by reducing on-chain activity, which negatively affected investor confidence.

Might interest you: What is BabyDoge?

However, Bitcoin’s volatile course did not deter institutional investors. US-based spot Bitcoin exchange-traded funds (ETFs) saw a total net inflow of $198.5 million on October 23.

You can join our Telegram channel to not miss the news and stay informed about the crypto world.