A massive $10 billion liquidation in Bitcoin futures open interest over the past two weeks is being considered a necessary “reset” for the market. Analysts suggest this process may pave the way for the continuation of the bull market in the coming periods.

Significant Decline in Bitcoin Futures!

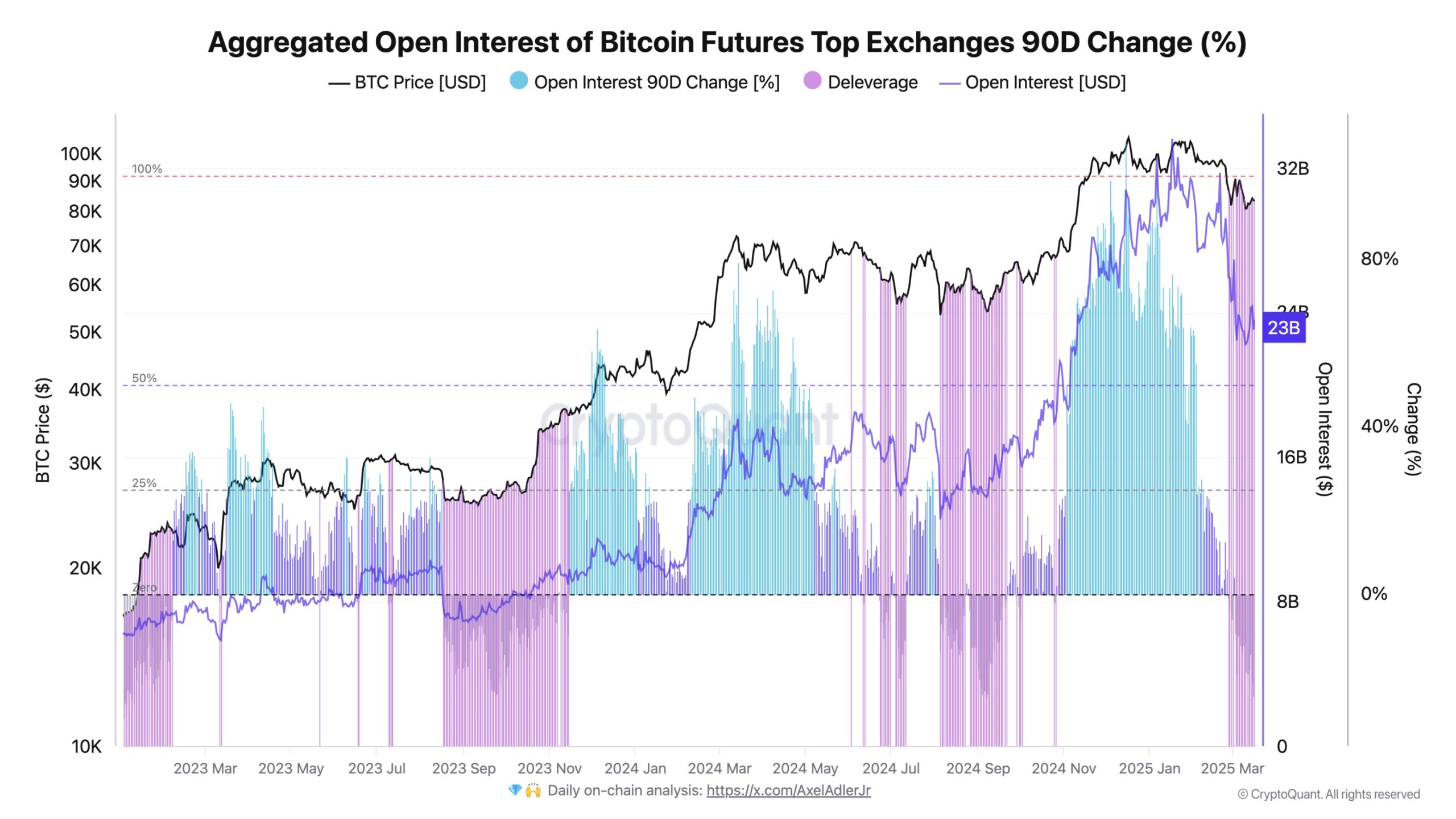

On-chain analytics platform CryptoQuant revealed in its March 17 “Quicktake” blog post that Bitcoin futures markets have undergone a significant deleveraging event. According to the report, aggregate open interest (OI) dropped by $10 billion between February 20 and March 4.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

Bitcoin (BTC) futures open interest had reached an all-time high of $33 billion on January 17, marking unprecedented levels of market leverage. However, following this peak, a sharp decline in risk appetite and the reduction of leveraged positions led to a significant drop in OI.

A Healthy Market Correction Process!

CryptoQuant analyst Darkfost described the decline as a “natural market reset.” According to the analyst, these types of liquidation periods are essential for maintaining the sustainability of an ongoing bullish trend.

Darkfost said, “Currently, Bitcoin futures open interest has decreased by 14% over a 90-day period. Historically, such deleveraging events have provided favorable opportunities in the short to medium term.”

Crypto Market Faces a ‘Demand Crisis’ Warning!

Another CryptoQuant analyst, Kriptolik, pointed out that derivative markets have become increasingly active since November 2024. However, the rise in stablecoin reserves on derivatives exchanges compared to spot markets indicates a lack of genuine demand in the spot market.

Kriptolik stated, “Despite the significant increase in total stablecoin supply since November 2024, the market and investors have not benefited substantially.” The analyst emphasized that the spot market is currently experiencing a “demand crisis.”

He added, “Until this distribution normalizes, avoiding high-leverage (high-risk) trades may be the most prudent approach.”

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.