Today, we will examine why Bitcoin is falling and how long this decline could continue. We will also assess whether the ETF approval had any impact on this decline.

You might like: What is Polyhedra Network?

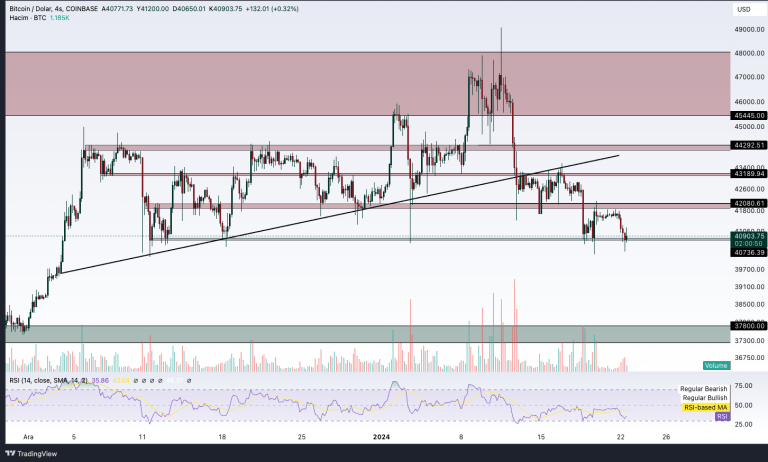

On January 10, Bitcoin rose to $49,000. After the ETF approval news, we saw a pullback to $45,800. The next day, it fell by 10% to $45,500 and has since fallen below $41,000. Let’s now examine what happened on the chart!

When we examine the chart in detail, as we mentioned earlier, the $45,500–$48,000 range stood out as a risky area. As the price tried to break through this range, we saw the expected pullback along with the ETF approval news. We believe that the initial sales were typically a “sell the news” strategy, but the subsequent declines show that investors are inclined to shift their funds between these two areas due to sales from crypto exchanges and attempts by large investment companies in the United States to sell Bitcoin.

In other words, we may be continuing this decline because investment companies are not buying back the Bitcoins they sold from exchanges with clear enthusiasm.

This sell-off wave first quickly fell to $42,000. Then, the support area was touched again with the break of the rising trend, followed by a retest movement. However, the $42,000 support level was broken with the subsequent sharp decline, and we are currently waiting for buyers’ reactions at the $40,735 level.

Bitcoin Analysis

If there are not enough buyers at this level, we believe that the next decline could be more severe and that altcoins could also be affected. After this break, our strongest support level is $37,800. In the graph below, we will examine Bitcoin‘s long-term chart in detail.

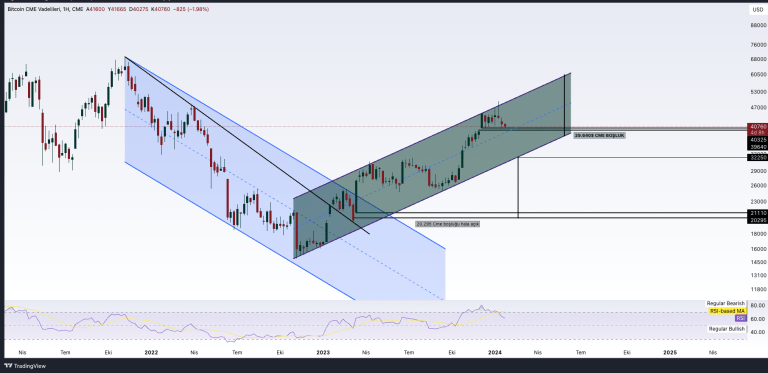

Taking a closer look at Bitcoin’s weekly chart, we observe that the rise that occurred with the ETF news continued to the upper band of the channel. However, it seems that sales have increased due to the inability to break the upper band of the channel. If the rising channel formation does not show an upward breakout, we can say that the next target could be the middle band of the channel. Currently, Bitcoin is approaching this area and there is also a CME gap at this level.

If Bitcoin cannot break the middle band of the channel, we think it could start an upward attack after filling the CME gap and that its next target could be above the $50,000 level. However, if the expected buyer pressure does not come from the middle band of the channel, we can say that the decline in Bitcoin could continue to $32,250.

Analysis

If the price reaches $32,000, we could see a strong upward reaction rise from the lower band of the channel and get a signal of the start of the bull market. However, if the crypto market is shaken by negative news during this process, the possibility of breaking the lower band of the channel may arise. Therefore, it is important for all our followers to be careful about this.

Although it is a low probability that the downward movement after the channel breakdown will coincide with the CME gap, we note that if this scenario occurs, the target could bring an average decline to $20,000.

In addition, when we evaluate this situation from the indicator, we observe that the RSI indicator is in the peak region weekly. Bitcoin has not usually started a rally while the weekly RSI is at the peak point before the mega bull. Therefore, if the middle band of the channel is broken, it is expected that the weekly RSI will reach low levels in the next sharp decline before the rally. After that, we can watch the long-term Bitcoin rise.

We hope that these declines will not happen and the uptrend will continue from where it left off. In light of these evaluations, we are ending our article here.