Haedal Protocol is an innovative liquid staking protocol natively developed on the Sui blockchain. It enables users to stake their SUI tokens while receiving haSUI, a liquid staking token, in return. This approach allows users to contribute to network security and actively participate in the DeFi ecosystem without locking up their assets.

This structure eliminates the limitations of traditional staking methods and offers a system that maximizes capital efficiency. Haedal Protocol is not just a staking platform; it also provides sustainable yield opportunities through protocol-based solutions like Haedal Market Maker (HMM), establishing a comprehensive DeFi infrastructure.

The Primary Objective of Haedal Protocol

Haedal Protocol allows users without technical expertise to stake their SUI tokens by delegating them to reliable validators. Instead of locking their funds as in classic staking systems, users receive haSUI tokens. These tokens can be used as liquidity assets and offer yield potential.

Why Liquid Staking?

The Sui network operates on a Delegated Proof of Stake (DPoS) mechanism, which requires a significant amount of SUI tokens to be staked for effective operation. However, not all users have the technical capability to run a validator.

You Might Be Interested In: Elon Musk Talks About the Name of a New Memecoin!

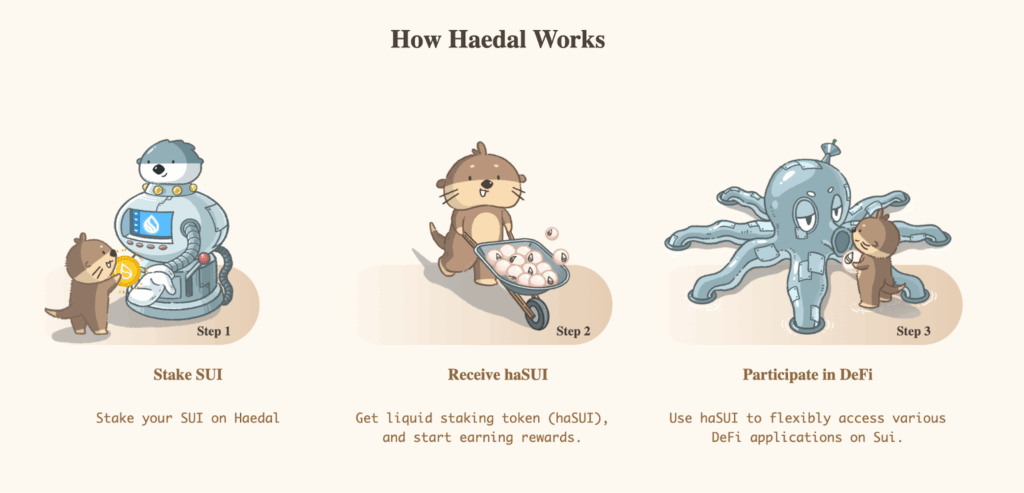

Haedal Protocol addresses this need by allowing users to stake their SUI tokens and receive haSUI in return. This enables users to earn staking rewards while maintaining the ability to utilize their tokens in DeFi applications.

What is the haSUI Token?

haSUI is the liquid staking token provided to users who stake their SUI tokens through Haedal Protocol. It represents the value of the staked asset and the accumulated staking rewards. Over time, its value increases, allowing users to passively grow their capital. Additionally, haSUI can be actively used in Sui DeFi protocols for lending, liquidity provision, and farming activities.

Haedal Market Maker (HMM)

Haedal Market Maker (HMM) is an automated market maker protocol developed by Haedal Protocol. It features high capital efficiency, low-risk transaction structures, and resistance to MEV attacks.

- High Capital Efficiency: Utilizes narrower trading ranges compared to CLAMM pools, optimizing capital usage.

- Low Drawdown Risk: The high transaction volume of Sui ensures immediate reflection of price fluctuations in liquidity positions.

- Anti-MEV Feature: Naturally resistant to front-run and sandwich attacks.

This system creates a sustainable passive income model for haSUI holders.

Products of Haedal Protocol

- Stake Platform: Users stake SUI tokens to receive haSUI, with both automatic and manual options available.

- DeFi Integrations: haSUI tokens can be used in DeFi protocols for lending, borrowing, and farming activities.

- HaeVault: A gamified staking product that offers an interactive vault system for users.

What is the HAEDAL Token?

HAEDAL is the native governance token of Haedal Protocol. It plays an active role in the protocol’s management, supports the liquid staking infrastructure, and facilitates future DeFi integrations.

On April 29, 2025, HAEDAL was listed on the Binance Alpha platform, significantly enhancing Haedal Protocol‘s global visibility and liquidity.

Tokenomics

- Token Name: Haedal Protocol

- Ticker: HAEDAL

- Total Supply: 1,000,000,000 HAEDAL

Token Distribution

- Ecosystem Incentives (55%): Allocated for user incentives, partnerships, and protocol adoption.

- Liquidity Fund (10%): Used for initial liquidity provision, CEX/DEX support, and strategic initiatives.

- Investors (15%): Subject to a 6-month lock-up, followed by a 12-month linear vesting schedule.

- Team & Advisors (20%): Subject to a 12-month lock-up, followed by a 24-month linear vesting schedule.

Note: The current graphical distribution shows Ecosystem Incentives at 45.5%, with the remaining 9.5% included in the general distribution.

Investment Round Details

On January 3, 2025, Haedal Protocol completed its Seed investment round, attracting support from prominent investors such as OKX Ventures, Hashed Fund, Animoca Brands, Flow Traders, Dewhales, and Comma3 Ventures. This strong investor profile underscores the confidence and potential backing Haedal Protocol.

The Future of Haedal Protocol

- Holds the highest TVL among liquid staking protocols on Sui.

- Achieved global recognition through its listing on Binance Alpha.

- Implements a comprehensive token distribution plan and sustainable yield models.

- Anticipates the announcement of new products and detailed tokenomics updates.

Official Links

- Website: Haedal

- X (Twitter): Haedal X

- Discord: Haedal Discord

- Whitepaper: Haedal Whitepaper

You can also freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram, YouTube, and Twitter channels for the latest news and updates.