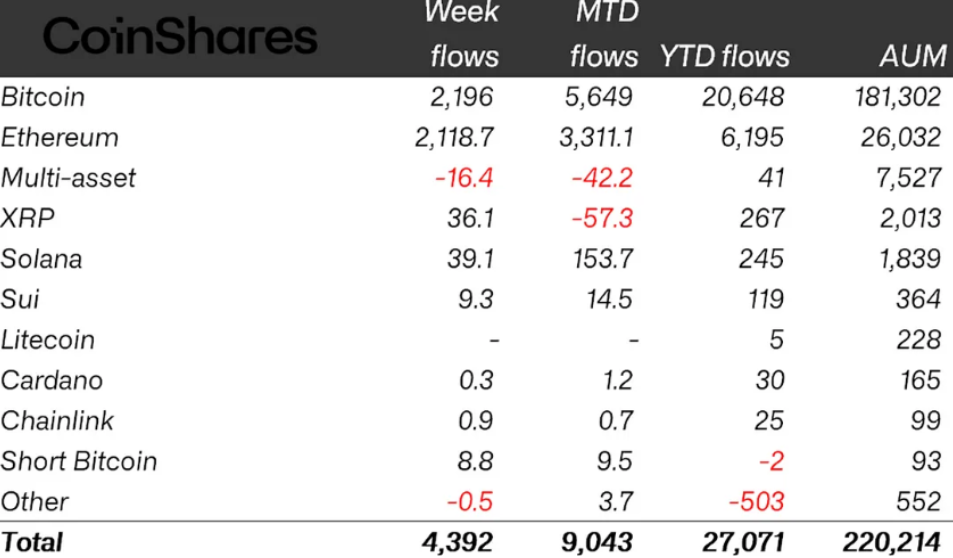

Crypto investment products attracted a record $4.4 billion in inflows last week. With this surge, total crypto ETP inflows in 2025 reached $27 billion. At the same time, total assets under management (AUM) surpassed $220 billion for the first time.

Although Bitcoin’s price reached an all-time high of $122,000 on July 14, it dropped to $116,000 during the week. However, it recovered to $120,000 over the weekend, closing the week strong. Despite price volatility, fund inflows remained steady. At the time of writing, Bitcoin is trading around $119,000.

Ethereum ETP Inflows Surpass Total 2024 Figures

Ethereum-based ETPs showed remarkable performance last week. Total inflows for 2025 reached $6.2 billion, already exceeding the full-year total for 2024.

Additionally, a record $2.12 billion flowed into Ethereum products on a weekly basis. CoinShares Head of Research James Butterfill commented, “In the past 13 weeks, inflows have accounted for 23% of Ethereum’s total AUM.”

ETH rose above $3,500 for the first time since January. After dropping below $1,500 in April 2025, Ethereum has rebounded strongly, regaining investor interest.

Bitcoin, Solana, and XRP Investors Keep Buying

Bitcoin ETPs saw $2.2 billion in inflows, making up 50% of total fund activity. This strong demand shows that despite new highs, investors are holding rather than taking profits.

Meanwhile, other major altcoins also attracted attention. Solana received $39 million, XRP $36 million, and Sui $9.3 million in inflows. These figures underscore institutional interest beyond Bitcoin. The diversity in portfolios shows a maturing market. Large inflows into layer-1 projects like Ethereum and Solana reflect long-term investor confidence.

The crypto ETP space hit new records in mid-2025 in terms of both volume and scope. However, how traditional market developments will affect this momentum remains to be seen.

You can freely share your thoughts and comments about the topic in the comment section. Additionally, don’t forget to follow us on our Telegram ,YouTube and Twitter channels for the latest news and updates.